How Does Your Income Work as a Legacy Agent?

What Does It Mean To Be A 1099 Contractor, 100% Commission Sales Professional?

You have uncapped income potential. Make $80,000 per year or $400,000 per year. It’s up to you. The individualization of financial returns attracts people who believe they have the focus, circumstances, and talent to excel at what they do.

Your income, often called compensation, works differently from a wage or salary. It can also be hard to predict at the outset. Let’s break it down.

You Are Paid Three Ways

1. Commission: You earn an initial commission when the insurance company issues an insurance policy you sold. We sell a wide range of insurance types that pay differently. They can be put in two baskets in terms of when and how much you’re paid.

Basket 1: Health & Medicare plans, final expense, dental, and similar sales pay a commission of $100 - $2,000 with a median of about $450. The insurance company must review and approve the application and your pay processed through commission accounting. This takes an average of three weeks.

Note that one particular product line, called Medicare Advantage, sales are an exception to this timeline during the last three months of the calendar year when many of these sales commissions do not pay until January.

Basket 2: Larger life and annuity sales pay $1,000 - $20,000+ with the median about $7,000. These are large, important financial decisions by the client, and require multiple appointments in addition to financial institutions cooperating. While they can sometimes commission in a few weeks, more often these cases take four to ten weeks.

2. Renewals: This income is often called residuals or passive income. After the first year of the insurance policy you sold, the insurance company pays you an additional commission each month. This continues for any number of years while your client keeps the policy you sold them. This can range from a few dollars per month to a couple hundred, with the median being about $25. As you gather more clients each year, your renewal income becomes a growing base, creating a reliable income stream for years to come.

3. Bonuses: Earn cash bonuses – on top of commissions – from sales incentive campaigns. Paid vacations around the globe are also a common, and incredibly fun, incentive pay.

Expectations In The First Year

The most difficult part of the career is the beginning as you ramp up your income. Recall that commissions take several weeks to end up in your bank account as follow up appointments, underwriting, funding, and commission processing complete. In your first couple months you are working hard to learn products, complete certifications, hone skills, and produce appointments. It is a very busy time with a lot of input compared to financial output.

In addition, you are splitting some of your sales compensation with a mentor on joint appointments. On one hand, your mentor’s training is invaluable. They will also close sales you did not even see. On the other hand, the split commissions reduce your income in the first couple months.

You may have to make up the difference in your cost of living with savings or spousal income in the early months or for a low commission month during the first year.

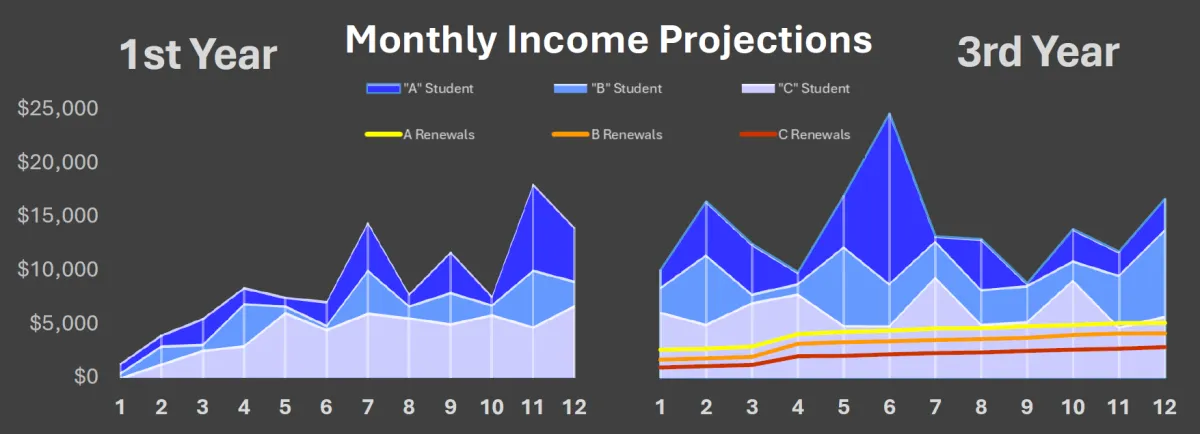

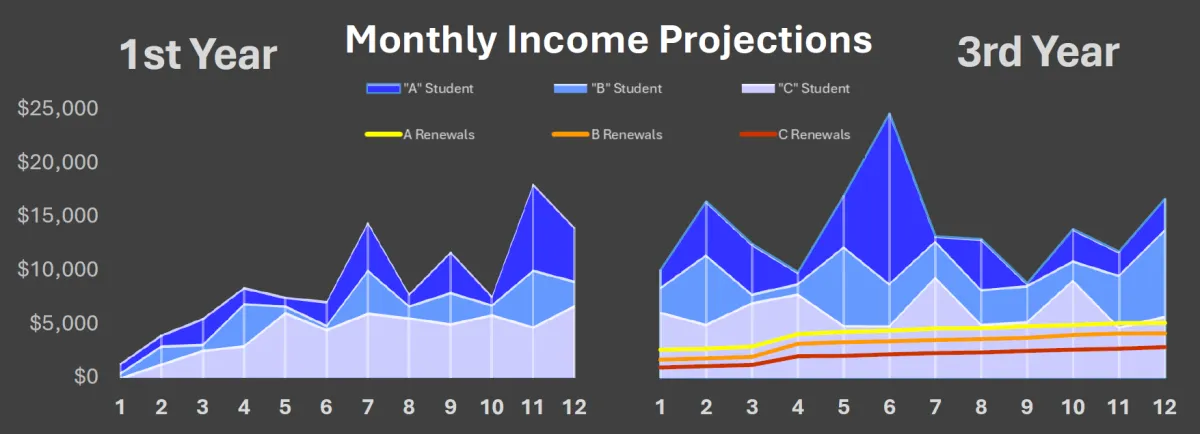

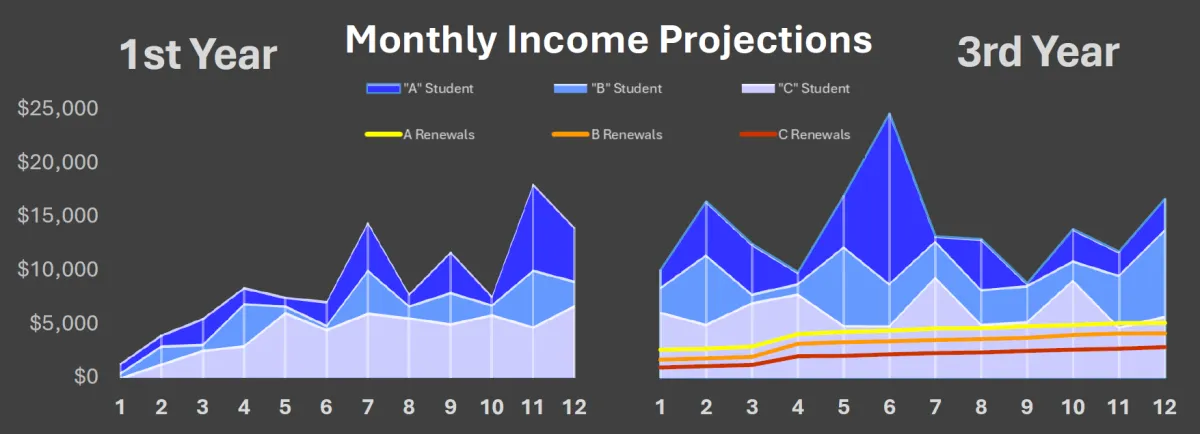

Here are some different agent monthly gross income results in their first and third years.

1st Year Compensation

Agent A = $107,378

Agent B = $75,445

Agent C = $51,480

3rd Year Compensation

Agent A = $167,338

Agent B = $120,945

Agent C = $73,604

3rd Year Renewals

Agent A = $49,949

Agent B = $38,317

Agent C = $24,701

Agents’ A, B, and C are composite averages of agent performance groups. Agents average 40-50 hour weeks and four weeks off in their first couple years. Our career rewards greater input with greater leverage. Beyond year three leverage comes from significant skill and reputation. Your hours become incredibly valuable.

You can see that renewals grow into a reliable base income. This turns what is traditionally a higher risk job – commission sales – into a financially secure career. Within three to four years, our agents become more financially secure as independent 1099 financial professionals than any W-2 employee.

Legacy Insurance & Financial Services, LLC is not affiliated with or endorsed by the Social Security Administration or any other government agency. Advisory services are offered by Simple Financial, LLC an Investment Advisor in the State of Utah. All content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions. Nor is it intended to be a projection of current or future performance or indication of future results. Purchases are subject to suitability. Specific to Medicare Advantage Plans and Medicare Part D Plans, we do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options. Opinions expressed herein are solely those of Legacy Insurance & Financial Services, LLC and our editorial staff. The information contained in this material has been derived from sources believed to be reliable but is not guaranteed as to accuracy and completeness and does not purport to be a complete analysis of the materials discussed. All information and ideas should be discussed in detail with your individual adviser prior to implementation. The information contained herein should in no way be construed or interpreted as a solicitation to sell or offer to sell insurance or advisory services to any residents of any state other than where legally permitted. Images and photographs are included for the sole purpose of visually enhancing the website. None of them are photographs of current or former clients. They should not be construed as an endorsement or testimonial from any of the persons in the photograph. Purchases are subject to suitability. By submitting any information on or through this site using a ‘submit’ button you agree by electronic signature to be contacted by a representative of Legacy Insurance & Financial Services, LLC by automated, prerecorded or manual SMS, text, email, or phone for the purpose of seeing to your request. The inclusion of any link is not an endorsement of any products or services by Legacy Insurance & Financial Services, LLC, or any of its associates. All links have been provided only as a convenience. These include links to websites operated by other government agencies, nonprofit organizations and private businesses. When you use one of these links, you are no longer on this site and this Privacy Notice will not apply. When you link to another website, you are subject to the privacy of that new site. When you follow a link to one of these sites neither Legacy Insurance & Financial Services, LLC, nor any agency, officer, or employee of Legacy Insurance & Financial Services, LLC warrants the accuracy, reliability or timeliness of any information published by these external sites, nor endorses any content, viewpoints, products, or services linked from these systems, and cannot be held liable for any losses caused by reliance on the accuracy, reliability or timeliness of their information. Portions of such information may be incorrect or not current. Any person or entity that relies on any information obtained from these systems does so at her or his own risk.

Site managed by Full Flex Marketing.

How Does

Your Income Work as a Legacy Agent?

What Does It Mean To

Be A 1099 Contractor,

100% Commission

Sales Professional?

You have uncapped income potential. Make $80,000 per year or $400,000 per year. It’s up to you. The individualization of financial returns attracts people who believe they have the focus, circumstances, and talent to excel at what they do.

Your income, often called compensation, works differently from a wage or salary. It can also be hard to predict at the outset. Let’s break it down.

You Are

Paid Three Ways

1. Commission: You earn an initial commission when the insurance company issues an insurance policy you sold. We sell a wide range of insurance types that pay differently. They can be put in two baskets in terms of when and how much you’re paid.

Basket 1

Health & Medicare plans, final expense, dental, and similar sales pay a commission of $100 - $2,000 with a median of about $450. The insurance company must review and approve the application and your pay processed through commission accounting. This takes an average of three weeks.

Note that one particular product line, called Medicare Advantage, sales are an exception to this timeline during the last three months of the calendar year when many of these sales commissions do not pay until January.

Basket 2

Larger life and annuity sales pay $1,000 - $20,000+ with the median about $7,000. These are large, important financial decisions by the client, and require multiple appointments in addition to financial institutions cooperating. While they can sometimes commission in a few weeks, more often these cases take four to ten weeks.

2. Renewals: This income is often called residuals or passive income. After the first year of the insurance policy you sold, the insurance company pays you an additional commission each month. This continues for any number of years while your client keeps the policy you sold them. This can range from a few dollars per month to a couple hundred, with the median being about $25. As you gather more clients each year, your renewal income becomes a growing base, creating a reliable income stream for years to come.

3. Bonuses: Earn cash bonuses – on top of commissions – from sales incentive campaigns. Paid vacations around the globe are also a common, and incredibly fun, incentive pay.

Expectations

In The First Year

The most difficult part of the career is the beginning as you ramp up your income. Recall that commissions take several weeks to end up in your bank account as follow up appointments, underwriting, funding, and commission processing complete. In your first couple months you are working hard to learn products, complete certifications, hone skills, and produce appointments. It is a very busy time with a lot of input compared to financial output.

In addition, you are splitting some of your sales compensation with a mentor on joint appointments. On one hand, your mentor’s training is invaluable. They will also close sales you did not even see. On the other hand, the split commissions reduce your income in the first couple months.

You may have to make up the difference in your cost of living with savings or spousal income in the early months or for a low commission month during the first year.

Here are some different agent monthly gross income results in their first and third years.

1st Year Compensation

Agent A = $107,378

Agent B = $75,445

Agent C = $51,480

3rd Year Compensation

Agent A = $167,338

Agent B = $120,945

Agent C = $73,604

3rd Year Renewals

Agent A = $49,949

Agent B = $38,317

Agent C = $24,701

Agents’ A, B, and C are composite averages of agent performance groups. Agents average 40-50 hour weeks and four weeks off in their first couple years. Our career rewards greater input with greater leverage. Beyond year three leverage comes from significant skill and reputation. Your hours become incredibly valuable.

You can see that renewals grow into a reliable base income. This turns what is traditionally a higher risk job – commission sales – into a financially secure career. Within three to four years, our agents become more financially secure as independent 1099 financial professionals than any W-2 employee.

Legacy Insurance & Financial Services, LLC is not affiliated with or endorsed by the Social Security Administration or any other government agency. Advisory services are offered by Simple Financial, LLC an Investment Advisor in the State of Utah. All content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions. Nor is it intended to be a projection of current or future performance or indication of future results. Purchases are subject to suitability. Specific to Medicare Advantage Plans and Medicare Part D Plans, we do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options. Opinions expressed herein are solely those of Legacy Insurance & Financial Services, LLC and our editorial staff. The information contained in this material has been derived from sources believed to be reliable but is not guaranteed as to accuracy and completeness and does not purport to be a complete analysis of the materials discussed. All information and ideas should be discussed in detail with your individual adviser prior to implementation. The information contained herein should in no way be construed or interpreted as a solicitation to sell or offer to sell insurance or advisory services to any residents of any state other than where legally permitted. Images and photographs are included for the sole purpose of visually enhancing the website. None of them are photographs of current or former clients. They should not be construed as an endorsement or testimonial from any of the persons in the photograph. Purchases are subject to suitability. By submitting any information on or through this site using a ‘submit’ button you agree by electronic signature to be contacted by a representative of Legacy Insurance & Financial Services, LLC by automated, prerecorded or manual SMS, text, email, or phone for the purpose of seeing to your request. The inclusion of any link is not an endorsement of any products or services by Legacy Insurance & Financial Services, LLC, or any of its associates. All links have been provided only as a convenience. These include links to websites operated by other government agencies, nonprofit organizations and private businesses. When you use one of these links, you are no longer on this site and this Privacy Notice will not apply. When you link to another website, you are subject to the privacy of that new site. When you follow a link to one of these sites neither Legacy Insurance & Financial Services, LLC, nor any agency, officer, or employee of Legacy Insurance & Financial Services, LLC warrants the accuracy, reliability or timeliness of any information published by these external sites, nor endorses any content, viewpoints, products, or services linked from these systems, and cannot be held liable for any losses caused by reliance on the accuracy, reliability or timeliness of their information. Portions of such information may be incorrect or not current. Any person or entity that relies on any information obtained from these systems does so at her or his own risk.

Site managed by Full Flex Marketing.

How does

your income work

as a Legacy agent?

What does it mean to be a 1099 contractor, 100% commission sales professional?

You have uncapped income potential. Make $80,000 per year or $400,000 per year. It’s up to you. The individualization of financial returns attracts people who believe they have the focus, circumstances, and talent to excel at what they do.

Your income, often called compensation, works differently from a wage or salary. It can also be hard to predict at the outset. Let’s break it down.

You are paid three ways.

1. Commission: You earn an initial commission when the insurance company issues an insurance policy you sold. We sell a wide range of insurance types that pay differently. They can be put in two baskets in terms of when and how much you’re paid.

Basket 1: Health & Medicare plans, final expense, dental, and similar sales pay a commission of $100 - $2,000 with a median of about $450. The insurance company must review and approve the application and your pay processed through commission accounting. This takes an average of three weeks.

Note that one particular product line, called Medicare Advantage, sales are an exception to this timeline during the last three months of the calendar year when many of these sales commissions do not pay until January.

Basket 2: Larger life and annuity sales pay $1,000 - $20,000+ with the median about $7,000. These are large, important financial decisions by the client, and require multiple appointments in addition to financial institutions cooperating. While they can sometimes commission in a few weeks, more often these cases take four to ten weeks.

2. Renewals: This income is often called residuals or passive income. After the first year of the insurance policy you sold, the insurance company pays you an additional commission each month. This continues for any number of years while your client keeps the policy you sold them. This can range from a few dollars per month to a couple hundred, with the median being about $25. As you gather more clients each year, your renewal income becomes a growing base, creating a reliable income stream for years to come.

3. Bonuses: Earn cash bonuses – on top of commissions – from sales incentive campaigns. Paid vacations around the globe are also a common, and incredibly fun, incentive pay.

Expectations In The First Year

The most difficult part of the career is the beginning as you ramp up your income. Recall that commissions take several weeks to end up in your bank account as follow up appointments, underwriting, funding, and commission processing complete. In your first couple months you are working hard to learn products, complete certifications, hone skills, and produce appointments. It is a very busy time with a lot of input compared to financial output.

In addition, you are splitting some of your sales compensation with a mentor on joint appointments. On one hand, your mentor’s training is invaluable. They will also close sales you did not even see. On the other hand, the split commissions reduce your income in the first couple months.

You may have to make up the difference in your cost of living with savings or spousal income in the early months or for a low commission month during the first year.

Here are some different agent monthly gross income results in their first and third years.

1st Year Compensation

Agent A = $107,378

Agent B = $75,445

Agent C = $51,480

3rd Year Compensation

Agent A = $167,338

Agent B = $120,945

Agent C = $73,604

3rd Year Renewals

Agent A = $49,949

Agent B = $38,317

Agent C = $24,701

Agents’ A, B, and C are composite averages of agent performance groups. Agents average 40-50 hour weeks and four weeks off in their first couple years. Our career rewards greater input with greater leverage. Beyond year three leverage comes from significant skill and reputation. Your hours become incredibly valuable.

You can see that renewals grow into a reliable base income. This turns what is traditionally a higher risk job – commission sales – into a financially secure career. Within three to four years, our agents become more financially secure as independent 1099 financial professionals than any W-2 employee.